Virginia

Tax Relief Professionals

Americans can face mounting federal, or state taxes owed that cannot be paid off. Tax debt relief companies can try to reduce your tax debt by representing your interests with the IRS. Below are the best tax professionals or search for what you’re looking for.

Top professionals

Advanced Tax Team

Min. Tax Debt Required

$10,000Average Fee

$3,800Minimum Fee

$295

Kristopher Beverly

Min. Tax Debt Required

not availableAverage Fee

not availableMinimum Fee

not available

Farzin Djafarnia

Min. Tax Debt Required

not availableAverage Fee

not availableMinimum Fee

not available

All 1599 professionals in Virginia

Kristopher Beverly

Farzin Djafarnia

Laura Guckert

Brandon Groseclose

Ashley Hanson

Karen Mercer

Mary Singleton

Scott Smith

The Adjuvancy, LLC (Roy Ackerman)

Mitra Dadashzadeh Ranjbar

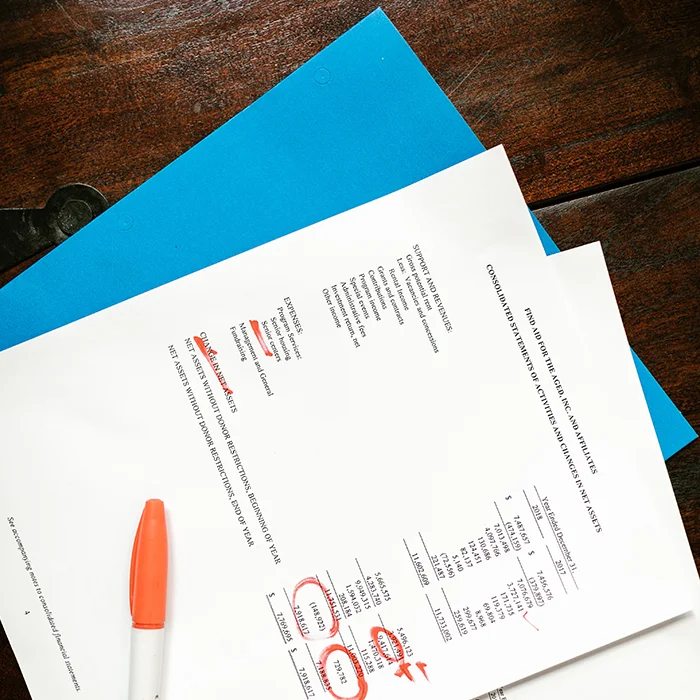

Evaluate your tax situation

By evaluating your tax situation, you can identify areas where you may be able to reduce your tax burden.

Wendy Skaggs

Mohammad Aamer

Hamida Abawi

Gail Abbott

Moses Abdallah

Girma Abebe

Walton Abernathy

Berhe Abraha

Abdulkarim Abualasrar

Biddanda Achia

Not here? Tell us what we’re missing

Help More people find you and submit you business for a free listing in our network.

Virginia has been facing an economic crisis not unlike ones being faced in the rest of the country. This is led to an increase in tax debt and predatory collection methods utilized by the IRS. People everywhere are trying to figure out how to fight back against the loss of their possessions and seeking tax relief everywhere possible.

For those living in VA, there are a number of taxpayer advocates that can help you to navigate your options and to understand how to avoid inflammatory debt. The first step comes in understanding what the IRS can do and the nature of their collection process.

IRS Collection Methods and Their Consequences

The IRS isn’t required to abide by normal legal collection processes. They don’t have to go to court in order to take immediate possession of your assets. As long as your home or vehicle doesn’t exceed the amount owed to the IRS, they can show up at your door with a possession order at any time.

This is usually a last resort, and they’ll send a number of certified letters that give you time to respond. You may also be facing a tax lien or wage garnishment when your assets aren’t enough to cover the immediate debt.

How to Defend Yourself Against Debt

When a person is can’t pay off their debt, they can file an offer in compromise to reduce the debt based on their income. This allows them to make a lump sum payment or to stretch payments out in a more manageable way.

For those suffering from the debt from their spouse, there is an innocent spouse relief option that allows them to absolve themselves of that responsibility. It can help to speak with a tax professional to learn about your options and what you can do to protect yourself today.

Search by city in Virginia

Top cities in Virginia

Abingdon

Alexandria

Annandale

Arlington

Ashburn

Ashland

Bedford

Big Stone gap

Blacksburg

Bristol

Burke

Cedar Bluff

Centreville

Chantilly

Charlottesville

Chesapeake

Chester

Chesterfield

Christiansburg

Colonial Heights

Covington

Crozet

Culpeper

Danville

Emporia

Fairfax

Falls Church

Farmville

Fishersville

Floyd

Forest

Franklin

Fredericksburg

Front Royal

Galax

Gladys

Glen Allen

Gloucester

Goochland

Great Falls

Gretna

Grundy

Hampton

Hanover

Harrisonburg

Henrico

Herndon

Hopewell

Kilmarnock

King George

Lawrenceville

Leesburg

Lexington

Louisa

Lovingston

Lynchburg

Manassas

Marion

Martinsville

Mclean

Mechanicsville

Newport News

Norfolk

Palmyra

Parksley

Pearisburg

Petersburg

Portsmouth

Powhatan

Providence Forge

Pulaski

Radford

Reston

Richmond

Roanoke

Rocky Mount

Rustburg

Salem

South Boston

Spotsylvania

Springfield

Stafford

Stanardsville

Staunton

Sterling

Stuart

Suffolk

Tazewell

Vienna

Virginia Beach

Warrenton

Warsaw

Waverly

Weber City

Williamsburg

Winchester

Woodbridge

Woodstock

Wytheville

Yorktown