Minnesota

Tax Relief Professionals

Americans can face mounting federal, or state taxes owed that cannot be paid off. Tax debt relief companies can try to reduce your tax debt by representing your interests with the IRS. Below are the best tax professionals or search for what you’re looking for.

Top professionals

Advanced Tax Team

Min. Tax Debt Required

$10,000Average Fee

$3,800Minimum Fee

$295

Lagene's Accounting & Tax (Rena Akers)

Min. Tax Debt Required

not availableAverage Fee

not availableMinimum Fee

not available

William Mclee

Min. Tax Debt Required

not availableAverage Fee

not availableMinimum Fee

not available

All 1097 professionals in Minnesota

Lagene's Accounting & Tax (Rena Akers)

William Mclee

Mary Acosta

Amy Acree

Babatola Agboola

George Ahlin

Ahmet Akyol

Joan Aldridge

Barm Alsbrook

Jane Amble

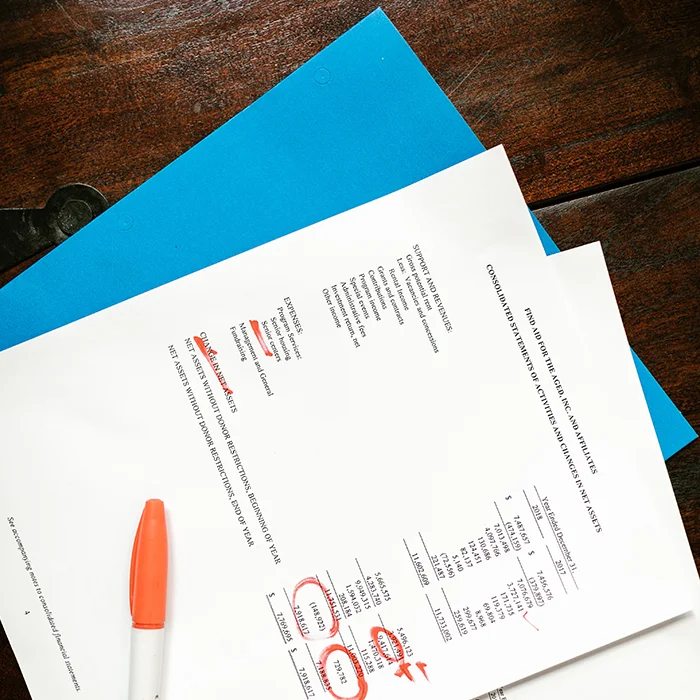

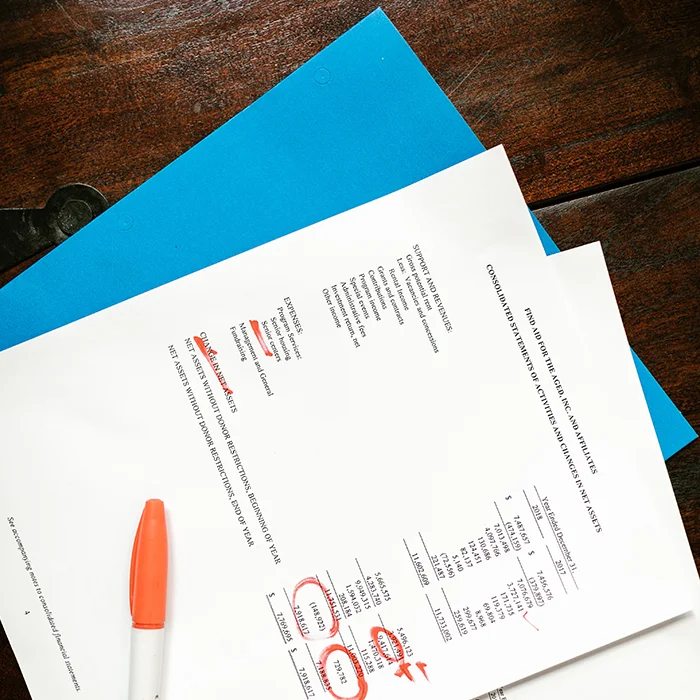

Evaluate your tax situation

By evaluating your tax situation, you can identify areas where you may be able to reduce your tax burden.

Rebekah Amstutz

Phyllis Anderson

Robert Anderson

Rochelle Anderson

Teresa Anderson

Bradley Anderson

Carolee Anderson

Donald Anderson

Dorothy Anderson

Gerald Anderson

Not here? Tell us what we’re missing

Help More people find you and submit you business for a free listing in our network.

Get Tax Relief for Tax Issues in Minnesota

When it comes to resolving tax issues in Minnesota, there are right and wrong ways to do it. If you’re faced with tax issues like a tax lien, the first step you should do is contact the IRS. If the IRS has sent you a bill and you failed to pay it, they will place a tax lien against your property or start a wage garnishment on your income. It can be very stressful, but if you if you call and get professional help, it may be a lot easier to navigate around.

How to Resolve Your Tax Issues

If you speak directly to the IRS, there is a better chance that they will be willing to work with you depending on your situations. Often, you will need to submit certain financial documentation that will be used to show what is your maximum ability in paying back your taxes and receiving some tax relief. If you are eligible, you may negotiate a payment collection alternative. Having a MN licensed tax attorney to help you can make all the difference. They’ll be able to explain all of your payment options and make things less stressful.

What to Do When You an IRS Notice

In Minnesota, you can get a consultation from tax attorneys on how you can settle any tax debt from back taxes as soon as possible. You can also request for advice on innocent spouse relief if your current or ex-spouse filed your taxes incorrectly. Make sure to apply for an offer in compromise; this means that you only pay a portion of what you owe in one payment. Whatever you do, it’s best to contact the IRS to end any wage garnishment or tax liens that have been put against you.

Search by city in Minnesota

Top cities in Minnesota

Albert Lea

Alexandria

Andover

Annandale

Anoka

Apple Valley

Aurora

Austin

Baxter

Bemidji

Blaine

Bloomington

Brainerd

Breckenridge

Brooklyn Center

Brooklyn Park

Buffalo

Burnsville

Caledonia

Cambridge

Carlton

Center City

Chanhassen

Chaska

Chisago City

Cloquet

Coon Rapids

Cottage Grove

Crookston

Crystal

Dawson

Deer River

Delano

Detroit Lakes

Dilworth

Duluth

Eagan

East Grand forks

Eden Prairie

Edina

Elk River

Eveleth

Fairmont

Faribault

Farmington

Fergus Falls

Forest Lake

Glencoe

Glenwood

Grand Rapids

Granite Falls

Ham Lake

Hastings

Hibbing

Hinckley

Hopkins

Hutchinson

International Falls

Inver Grove heights

Kasson

La Crescent

Lake Elmo

Lakeville

Litchfield

Little Falls

Luverne

Mahnomen

Mankato

Maple Grove

Maple Lake

Maplewood

Marshall

Mendota Heights

Minneapolis

Minnetonka

Montevideo

Monticello

Moorhead

Mora

Morris

Nevis

New Brighton

New Ulm

New York mills

Northfield

Oakdale

Olivia

Onamia

Otsego

Owatonna

Park Rapids

Paynesville

Perham

Pine City

Pipestone

Plymouth

Preston

Princeton

Prior Lake

Red Wing

Redwood Falls

Richfield

Rochester

Rogers

Roseau

Roseville

Saint Cloud

Saint Louis park

Saint Paul

Saint Peter

Sauk Centre

Sauk Rapids

Scandia

Shakopee

Stillwater

Thief River falls

Virginia

Wabasha

Waconia

Waseca

Waverly

Willmar

Windom

Winona

Woodbury

Worthington

Wyoming