Arkansas

Tax Relief Professionals

Americans can face mounting federal, or state taxes owed that cannot be paid off. Tax debt relief companies can try to reduce your tax debt by representing your interests with the IRS. Below are the best tax professionals or search for what you’re looking for.

Top professionals

Advanced Tax Team

Min. Tax Debt Required

$10,000Average Fee

$3,800Minimum Fee

$295

Bailey & Thompson Tax & Accounting (Alfred Bailey)

Min. Tax Debt Required

not availableAverage Fee

not availableMinimum Fee

not available

Campbell's Tax Service (Alice Campbell)

Min. Tax Debt Required

not availableAverage Fee

not availableMinimum Fee

not available

All 524 professionals in Arkansas

Bailey & Thompson Tax & Accounting (Alfred Bailey)

Campbell's Tax Service (Alice Campbell)

Judy Coker

Cox Accounting Services LLC (Donald Cox)

Shirley Crihfield

Davis Clark Butt Carithers & Taylor (Jeffrey Davis)

Brandon Harklau

Tamara Keeter

Rhonda Burkett Income Tax Services

Dawn Kennedy

Evaluate your tax situation

By evaluating your tax situation, you can identify areas where you may be able to reduce your tax burden.

Leanne Allbritton

David Allen

Sandra Alvis

Joyce Anderson

Terry Anderson

Ashley Appel

James Askeland

Jaclyn Atkinson

Shederick Austin

Jalena Bagley

Not here? Tell us what we’re missing

Help More people find you and submit you business for a free listing in our network.

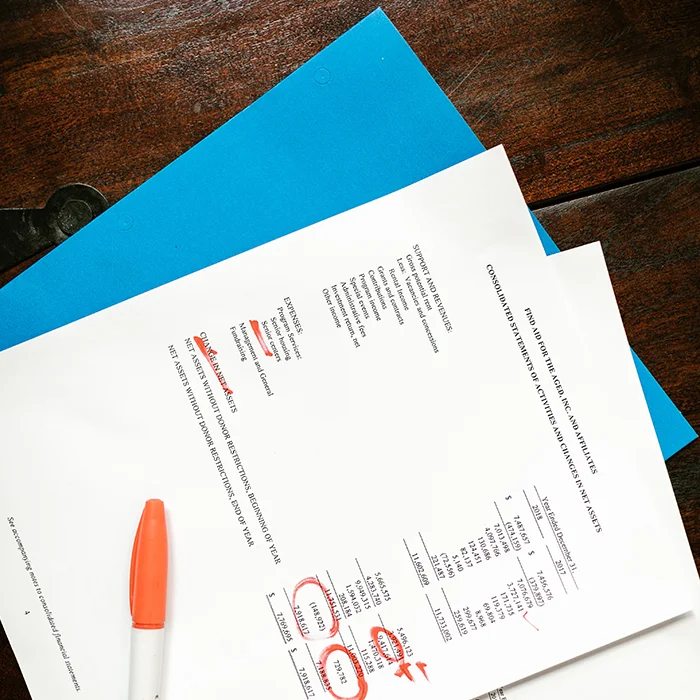

The IRS audits people each and every year after they file taxes. Audits happen for many reasons, including claiming charitable donations, not claiming income or simply for mistakes made when filing. If you are audited by the IRS, it’s best to hire an enrolled agent or tax attorney right away. The following guide provides insight on the many ways an enrolled agent in Arkansas can make getting tax relief with the IRS easier after an audit.

Have the Filing Double-Checked

Many taxpayers make the mistake of thinking that they IRS is always right. If the IRS audits them and says that they owe money, they assume that they do. This isn’t always the case, though. Even IRS agents make mistakes. An enrolled agent is thoroughly trained in tax law to ensure that any issues can be identified and addressed when reviewing your filing. They can let you know if the IRS is right in their claims. They can also let you know if you missed credits or deductions available to you.

Contest Issues that Are Discovered in Arkansas

If the IRS has made a mistake with the audit, the enrolled agent will know how to contest their claims properly. They will know what information you need to provide to prove your claims and get tax relief. Dealing with the IRS directly can be overwhelming if you aren’t educated about tax law. The enrolled agent will be able to explain the tax law to you and what issues the IRS has with your filing. The agent knows what paperwork needs to be filled out and how to do it to make the process easier. The agents in Arkansas know the difference between the laws regarding state taxes and federal taxes, so they can handle any issues that arise.

Negotiate Penalties and Fines for Tax Relief

If the IRS attaches fines or penalties to your filing, the agent can help you negotiate with the IRS agent. Just because the IRS claims you have to pay a certain amount, it doesn’t mean that it’s set in stone. The enrolled agent knows what reasonable amounts are for the negotiation because they have experience negotiating with the IRS in the past.

Establish a Payment Plan

There are times when the fines and penalties can be quite large. Most people don’t have large amounts of money saved up to pay the fines and penalties in a lump sum. The enrolled agent can negotiate with the IRS to create a payment plan that is affordable and reasonable.

Search by city in Arkansas

Top cities in Arkansas

Arkadelphia

Barling

Batesville

Benton

Bentonville

Berryville

Blytheville

Booneville

Brinkley

Bryant

Cabot

Camden

Clarksville

Clinton

Conway

Corning

Crossett

Danville

Dardanelle

De Queen

Dumas

El Dorado

Fayetteville

Fordyce

Forrest City

Fort Smith

Gassville

Greenwood

Hamburg

Harrison

Heber Springs

Helena

Hope

Hot Springs

Hot Springs national park

Hoxie

Huntsville

Imboden

Jacksonville

Jonesboro

Lake Village

Lewisville

Little Rock

Lonoke

Magnolia

Malvern

Marianna

Marion

Maumelle

Melbourne

Mena

Monticello

Morrilton

Mountain Home

Mountain View

Nashville

Newport

North Little rock

Ozark

Paragould

Paris

Perryville

Pine Bluff

Pocahontas

Prescott

Rogers

Russellville

Salem

Searcy

Sheridan

Sherwood

Siloam Springs

Springdale

Stuttgart

Texarkana

Trumann

Van Buren

Waldron

Walnut Ridge

Warren

West Helena

West Memphis

Wynne

Yellville