Utah

Tax Relief Professionals

Americans can face mounting federal, or state taxes owed that cannot be paid off. Tax debt relief companies can try to reduce your tax debt by representing your interests with the IRS. Below are the best tax professionals or search for what you’re looking for.

Top professionals

Advanced Tax Team

Min. Tax Debt Required

$10,000Average Fee

$3,800Minimum Fee

$295

Oso Tax Service

Min. Tax Debt Required

not availableAverage Fee

not availableMinimum Fee

not available

Jacques Behar

Min. Tax Debt Required

not availableAverage Fee

not availableMinimum Fee

not available

All 543 professionals in Utah

Oso Tax Service

Jacques Behar

Jeffery Dalebout

Richard Adam

Carlosromo Adkins

Opal Ahrens

Sherry Almquist

Luanne Ander

Kathryn Anderson

Conrad Anderson

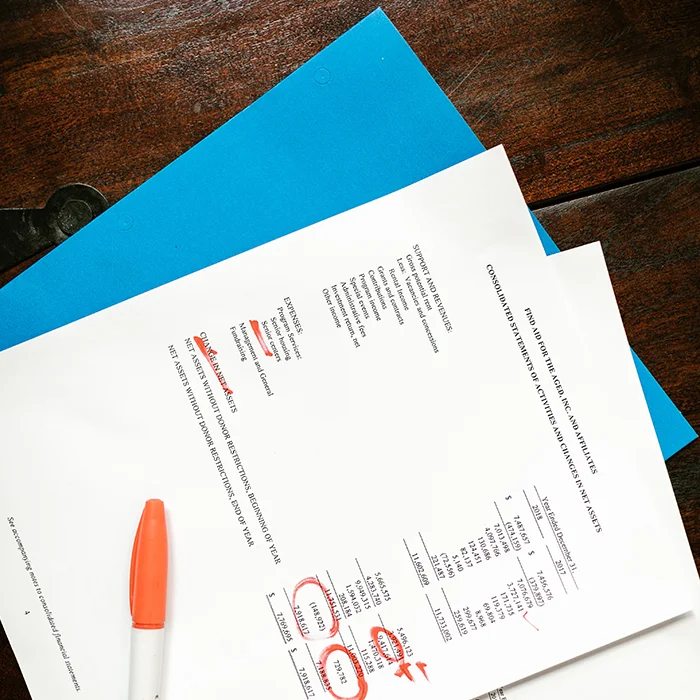

Evaluate your tax situation

By evaluating your tax situation, you can identify areas where you may be able to reduce your tax burden.

Joel Asay

David Ashby

Danielle Atchley

Preston Back

Lynn Baldwin

Thomas Baldwin

Stanley Ballif

Erin Barbee

George Barton

Justin Baugh

Not here? Tell us what we’re missing

Help More people find you and submit you business for a free listing in our network.

Utah has been experiencing a similar issue with back taxes and aggressive collection techniques as the rest of the country. As the economy has started to recover, many people are still struggling with unpaid tax debts that have risen into the tens of thousands. Unfortunately, the IRS isn’t particularly forgiving with the amount owed, and interest rates and fees can add up quickly.

It can help to contact your UT taxpayer advocate for more information or if you believe that the debt owed is incorrect. Don’t be afraid to seek out tax relief from reputable and knowledgeable sources.

What Will the IRS Do?

When you owe money to the IRS, they have a bevy of aggressive collection techniques open to them. They aren’t required to abide by normal legal procedures and can take immediate possession of your assets without obtaining a court order. This is an extreme tactic, and not usually one that’s commonly used.

At first, the IRS will send you a number of official letters asking you to make payment arrangements. Ignoring these can lead to tax liens, wage garnishment, frozen bank accounts, and the eventual possession of your hoe or business. It’s always better to be proactive when dealing with tax problems.

Taking Steps to Protect Yourself

Owing a huge sum can be overwhelming for those behind on their taxes. Filing an offer in compromise allows you to reduce this sum and to consolidate your debt into a set number of manageable payments. This number is based on your current financial situation and can be a great way to seek tax relief for those who’ve fallen on hard financial times.

Having a spouse with tax issues can mandate innocent spouse relief, which protects one person from the tax debt of their husband or wife. There are options, and it can help to contact a tax relief professional.

Search by city in Utah

Top cities in Utah

American Fork

Beaver

Bluffdale

Bountiful

Brigham City

Cedar City

Clearfield

Draper

Eagle Mountain

Ephraim

Fillmore

Heber City

Herriman

Highland

Hurricane

Kamas

Kanab

Kaysville

Layton

Lehi

Lindon

Logan

Magna

Midvale

Midway

Moab

Murray

Nephi

North Salt lake

Ogden

Orem

Park City

Payson

Pleasant Grove

Price

Providence

Provo

Richfield

Riverton

Roosevelt

Roy

Saint George

Salt Lake city

Sandy

Santa Clara

Saratoga Springs

South Jordan

Spanish Fork

Springville

Syracuse

Taylorsville

Tooele

Toquerville

Tremonton

Vernal

Wendover

West Jordan

West Valley city

Woods Cross